January 17, 2023

For Buyers, For Sellers, Pricing

Have Home Values Hit Bottom?

Whether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that’s raising concerns about a repeat of what happened to prices in the crash in 2008.

One of the questions that’s on many minds, based on those headlines, is: how much will home prices decline? But what you may not realize is expert forecasters aren’t calling for a free fall in prices. In fact, if you look at the latest data, there’s a case to be made that the biggest portion of month-over-month price depreciation nationally may already behind us – and even those numbers weren’t significant declines on the national level. Instead of how far will they drop, the question becomes: have home values hit bottom?

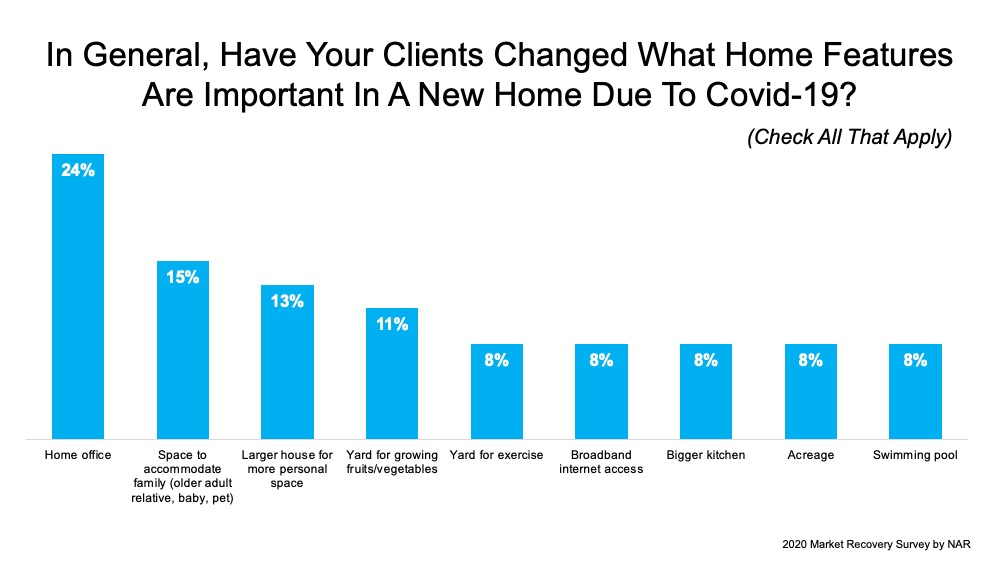

Let’s take a look at the latest data from several reputable industry sources (see chart below):

The chart above provides a look at the most recent reports from Case-Shiller, the Federal Housing Finance Agency (FHFA), Black Knight, and CoreLogic. It shows how, on a national scale, home values have changed month-over-month since January 2022. November and December numbers have yet to come out.

Let’s focus in on what the red numbers tell us. The red numbers are the change in home values over the last four months that have been published. And if we isolate the last four months, what the data shows is, in each case, home price depreciation peaked in August.

While that doesn’t guarantee home price depreciation has hit bottom, it confirms prices aren’t in a free fall, and it may be an early signal that the worst is already behind us. As the numbers for November and December are released, data will be able to further validate this national trend.

Bottom Line

Home prices month-over-month have depreciated for the past four months on record, but there’s a strong case to be made that the worst may be behind us. If you have questions about what’s happening with home prices in your local market, reach out to a trusted real estate professional.

January 10,2021.

The Importance of Having the right amount of insurance.

Purchase The Right Amount Of Home Insurance

December 29, 2020 by Matt Goeglein

For most people, their home is the most valuable investment they will ever make. Therefore, it needs to be protected. This is where homeowners’ insurance is critical. At the same time, buying the right amount of homeowners’ insurance can be a bit of a challenge.

For most people, their home is the most valuable investment they will ever make. Therefore, it needs to be protected. This is where homeowners’ insurance is critical. At the same time, buying the right amount of homeowners’ insurance can be a bit of a challenge.

A home that is underinsured leaves the homeowner vulnerable to situations involving fires, floods, and theft. On the other hand, nobody wants to throw away money unnecessarily by over-insuring the home. How can everyone purchase the right amount of homeowners’ insurance?

Review The Coverage Every Year

First, people’s needs are going to change from year to year. Therefore, everyone should review their policy annually. For example, actual cash value only reimburses someone based on the current condition of the home. For example, if a home was built ten years ago, the actual cash value will only provide someone with the depreciated value of the home and not the original value. While this might be enough at the beginning, it may not be enough ten years from now. Everyone has to make sure they purchase enough insurance to cover the cost of rebuilding the home, excluding the cost of the land.

Overlooking Valuables And Liability

Another common mistake that people make when it comes to homeowners’ insurance is overlooking issues such as valuables and liability. Most people have enough insurance for the structure of the home. Most people do not have enough insurance to cover liability claims and valuables. Liability claims might arise if someone gets hurt on the property and the homeowner gets sued. Valuables are important if the home burns down or if someone steals something from the home. All homeowners must have enough homeowners’ insurance to protect themselves against potential liability claims (such as someone slipping and falling in the home) and the loss of valuables (such as electronics and jewelry). Everyone has to make sure they document these valuables appropriately.

Purchase The Right Amount Of Homeowners’ Insurance

Make sure you include everything to purchase the right amount of homeowners’ insurance. Review current construction costs as part of the process. Finally, review the fine print of the homeowners’ insurance policy every year to avoid being underinsured or over-insured.

For Sale By Owner Process

Selling via FSBO can be a daunting task, a seller can sell their home on their own. However, the seller assumes all responsibility and ownership of the selling process.

Although each property and type of real estate transaction can have varying steps involved, below are a few of the most common responsibilities and tasks for the seller in an FSBO transaction.

- The asking price must be determined and researched using property values in the neighborhood for homes that have similar features, such the number of bathrooms and square footage.

- Marketing the home would include advertising, listings online, brochures, and fliers that need to be created and distributed.

- The seller must schedule all of the showings or appointments.

- Once an offer has been made and accepted, the seller must negotiate the price with the buyer and write up the conditions of the sale that was agreed upon.

- The seller must prepare all of the legal documents, including the bill of sale showing the details of the transaction.

- Once the seller and buyer sign the contracts, the closing of the sale can be completed and the seller signs over the deed of the home to the buyer.

Benefits of Listing as For Sale By Owner (FSBO)

When an individual homeowner chooses to sell a house, traditionally they hire a real estate agent or broker to handle the sale. Going through an agent or broker can save a homeowner a lot of time. However, commissions can reduce the seller’s profits, whereby the average commission runs around 6% of the home’s selling price.

Special Considerations

Savings thousands of dollars in commissions can be tempting. However, it’s important to remember that when a seller doesn’t employ a real estate agent, the seller assumes all the responsibilities of completing the transaction.

If the seller is unfamiliar with the home buying and selling process, any mistake can be quite costly. For example, if when determining the asking price, the seller asks for too much, it could lead to a lost sale as potential buyers avoid the home. However, if the seller asks for too low of an asking price, the lost money that could have been earned from the sale might be more than the amount saved from avoiding the real estate commissions. In some cases, an appraiser might be needed or even requested by the buyer.

Also, there can be legal risks with selling the home via FSBO if the legal documents are not drawn up properly or if issues about the home aren’t adequately disclosed. Depending on the experience of the seller, avoiding the commission can be a wise financial decision. However, those who have little knowledge of real estate transactions can find the situation stressful and may be better off using a qualified real estate agent.

There are approximately 181 steps an agent execute on your behalf once you sign your listing with him/her. This diagram is just a brief example of what an agent does for you:

The majority of FSBO sellers still have to pay 3% in real estate commission. Successful FSBO sellers save themselves a fee for their listing agent, but most still have to pay the agent who brought in a willing buyer.

According to NAR, a typical FSBO home sells for $200,000, while a typical home sold by an agent sells for $265,500. That adds up to homes sold by agents getting an average of 23% more than FSBO sales. This number reflects the expertise real estate agents bring to a sale.

The Bottom Line is having an agent selling your home will save you a lot of headaches, getting your home priced right which will help it sells faster and save money, getting maximum marketing to attract thousands of buyers, negotiate on your behalf to get the highest price, and most importantly to handle all legal documents in the transaction to protect you.

07.21.20

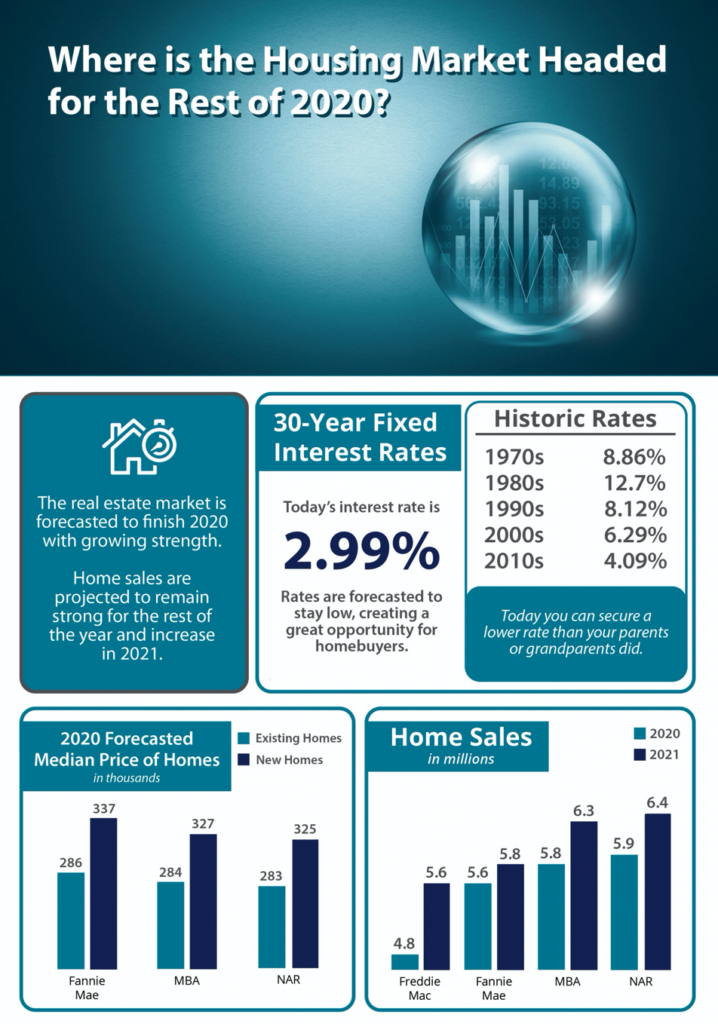

A Remarkable Recovery for the Housing Market

For months now the vast majority of Americans have been asking the same question: When will the economy turn around? Many experts have been saying the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light. With record-low mortgage rates driving high demand from potential buyers, homes are being purchased at an accelerating pace, and it’s keeping the housing market and the economy moving.

Here’s a look at what a few of the experts have to say about today’s astonishing recovery. In more than one instance, it’s being noted as truly remarkable.

Ali Wolf, Chief Economist, Meyers Research

“The housing recovery has been nothing short of remarkable…The expectation was that housing would be crushed. It was—for about two months—and then it came roaring back.”

“Recent home purchase measures have continued to show remarkable strength, leading us to revise upward our home sales forecast, particularly over the third quarter. Similarly, we bumped up our expectations for home price growth and purchase mortgage originations.”

Javier Vivas, Director of Economic Research for realtor.com

“All-time low mortgage rates and easing job losses have boosted buyer confidence back to pre-pandemic levels.”

James Knightley, Chief International Economist, ING

“At face value this is remarkable given the scale of joblessness in the economy and the ongoing uncertainty relating to the path of Covid-19…The outlook for housing transactions, construction activity and employment in the sector is looking much better than what looked possible just a couple of months ago.”

Bottom Line

The strength of the housing market is a bright spark in the economy and leading the way to what is truly being called a remarkable recovery throughout this country. If you’re thinking of buying or selling a home, maybe this is your year to make a move after all.

Does Your Home Have What Buyers Are Looking For?

There’s great opportunity for today’s homeowners to sell their houses and make a move, yet due to the impact of the ongoing health crisis, some sellers are taking their time coming back to the market. According to Javier Vivas, Director of Economic Research at realtor.com:

“Sellers continue returning to the market at a cautious pace and further improvement could be constrained by lingering coronavirus concerns, economic uncertainty, and civil unrest.”

For homeowners who need a little nudge of motivation to get back in the game, it’s good to know that buyers are ready to purchase this season. After spending several months at home and re-evaluating what they truly want and need in their space, buyers are ready and they’re in the market now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) explains:

“A number of potential buyers noted stalled plans due to the pandemic and that has led to more urgency and a pent-up demand to buy…After being home for months on end – in a home they already wanted to leave – buyers are reminded how much their current home may lack certain desired features or amenities.”

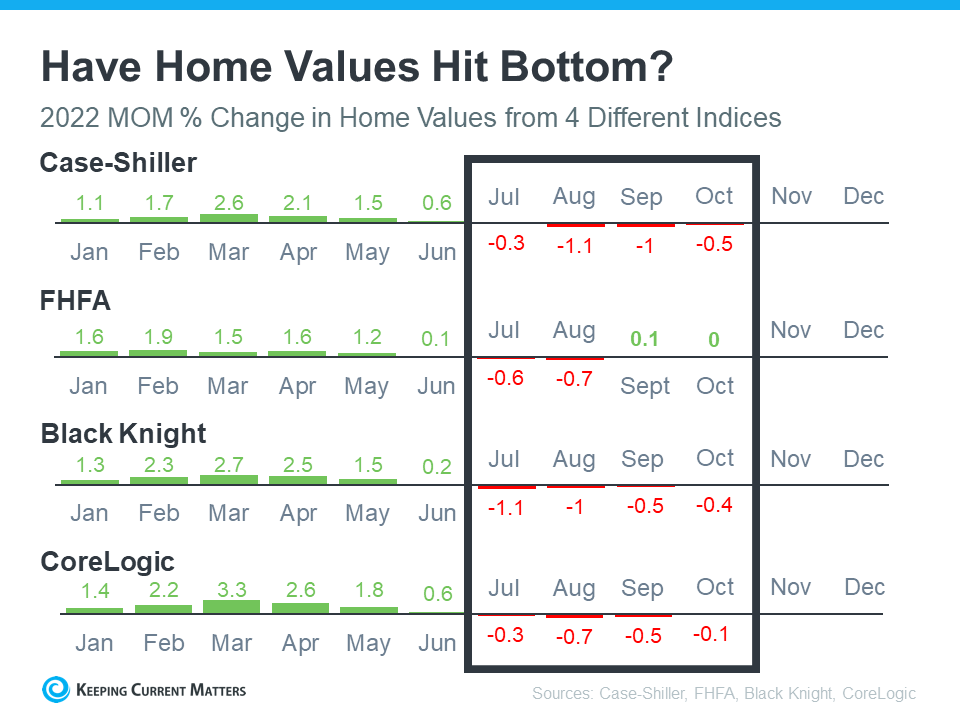

The latest Market Recovery Survey from NAR shares some of the features and amenities buyers are looking for, especially since the health crisis has shifted many buyer priorities. The most common home features cited as increasingly important are home offices and space to accommodate family members new to the residence (See graph below):The survey results also show that among buyers who indicate they would now like to live in a different area due to COVID-19, 47% have an interest in purchasing in the suburbs, 39% cite rural areas, and 25% indicate a desire to be in small towns.

As we can see, buyers are eager to find a new home, but there’s a big challenge in the market: a lack of homes available to purchase. Danielle Hale, Chief Economist at realtor.com explains:

“The realtor.com June Housing Trends Report showed that buyers still outnumber sellers which is causing the gap in time on market to shrink, prices to grow at a faster pace than pre-COVID, and the number of homes available for sale to decrease by more than last month. These trends play out similarly in the most recent week’s data with the change in time on market being most notable. In the most recent week homes sat on the market just 7 days longer than last year whereas the rest of June saw homes sit 2 weeks or more longer than last year.”

In essence, home sales are picking up speed and buyers are purchasing them at a faster rate than they’re coming to the market. Hale continues to say:

“The housing market has plenty of buyers who would benefit from a few more sellers. If the virus can be contained and home prices continue to grow, this may help bring sellers back to the housing market.”

Bottom Line

If you’re considering selling and your current house has some of the features today’s buyers are looking for, let’s connect. You’ll likely be able to sell at the best price, in the least amount of time, and will be able to take advantage of the low interest rates available right now when buying your new home.

Thinking of Selling Your House? Now May be the Right Time

Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there are sellers selling them, so the scale is tipped in favor of the sellers.

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), total housing inventory is down 18.8% from one year ago. Inventory is well below what was available last year, and the houses that do come to the market are selling very quickly.

Sam Khater, Chief Economist at Freddie Mac notes:

“Simply put, new housing supply is not keeping up with rising demand. We estimate that the housing market is undersupplied by 3.3 million units, and the shortage is rising by about 300,000 units a year. More than half of all states have a housing shortage.”

Why is inventory so low?

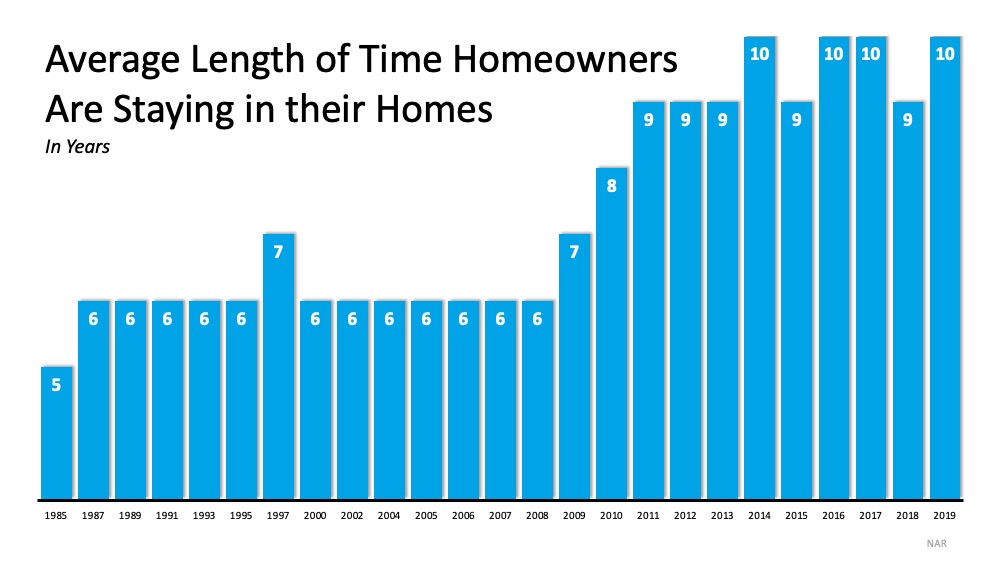

There are many reasons why it’s hard to find a home to buy today, stemming from an undersupply of newly constructed homes to sellers pressing pause on their moving plans due to the current health pandemic. One of the key factors making it even more challenging, however, is the amount of time current homeowners are staying in their homes. There has truly been a fundamental shift in the market that started about 10 years ago: people are staying put longer, and it’s contributing to the shortage of houses for sale.

In the 2019 Profile of Home Buyers and Sellers, NAR explained:

“In 2019, the median tenure for sellers was 10 years…After 2008, the median tenure in the home began to increase by one year each year. By 2011, the median tenure reached nine years, where it remained for three consecutive years, and jumped up again in 2014 to 10 years.”

As shown in the graph below, historical data indicates that staying in a home for 5-7 years used to be the norm, until the housing bubble burst. Since 2010, that length of time has trended upward, toward 9-10 years, largely due to homeowners aiming to recoup their equity:Thankfully, with the strength the market has gained over the last 10 years, today’s homeowners are in a much better equity position. Now is a fantastic time for homeowners who are ready to make a move to break the 10-year trend and sell their houses, especially while buyer demand is so high and inventory is so low. It’s a prime time to sell.

In addition, with today’s historically low interest rates, there’s an opportunity for sellers to maintain a low monthly payment while getting more house for their money. Think: move-up opportunity, more square footage, or finding the features they’re really looking for rather than doing costly renovations. With more new homes poised to enter the market this year, homeowners ready to make a move may have a golden opportunity to do so right now.

Bottom Line

There are simply not enough houses for sale today. If you’re ready to leverage your equity and sell your house, let’s connect today. It’s a great time to move while demand for homes to buy is extremely high.

Three Key Tips for Assessing Value To Find Out How Much Your Home Worth in Today’s Market

July 10, 2020 by Matt Goeglein

If you’re thinking about putting the house on the market, or are simply curious about its value in the current economic atmosphere, it’s essential to get an honest assessment of its value. An overly inflated figure won’t hold up and will only turn potential buyers away.

It’s best to get a fair assessment in order to ask a reasonable price or avoid over-extending oneself when it comes to taking out a home equity loan. Consider these three key tips to get a true assessment of a home’s value.

Identify Positive Features About The Home And Property

When seeking an appraisal for a home, it’s important to look at the big picture. While the neighborhood and specific location are important, as well as the size and condition of the home, it’s also essential to tally up any improvements or upgrades. Any recent renovations are a plus that are sure to give a boost to a home’s value.

Outbuildings and swimming pools add more positives that will increase the initial value of a home. The most important thing any homeowner can do is to stay on top of repairs and give the property a facelift periodically to keep things fresh. This will be taken into consideration during an appraisal.

Pay Attention To The Competition

Whether homeowners try to estimate their home’s value on their own or bring in the professionals, it’s important to pay attention to the surrounding real estate. Take a close look at other properties in the area and their price tags when they come up for sale. It’s especially helpful to look at properties that compare in size and condition. From that point, the most expensive and least expensive homes should be tallied as well, providing a price range for the concerned individual’s home.

Think About Present Circumstances

Be sure to consider if the area is in a recession or showing a period of strong economic growth. If a home is located in an area that is booming, this will inflate the value of the home. It is all part of the law of supply and demand. When buyers are coming in droves, home sales will be ripe for the picking and homeowners can ask a higher price.

However, if the population is dwindling and people are migrating elsewhere because job opportunities have fallen, there is a much greater chance that the home’s value will decrease. For those who want to sell, the best bet is to strike when the iron is hot and put the house on the market during a period of economic strength. If the economy is failing, it may be necessary to wait or cut ones’ losses.

Act Now To Learn More

There is no better time than the present to contact a name you can trust in real estate. Discover all the ins and outs of assessing your home’s value, discuss your options, and find out ways to boost your property’s potential as you seek a reliable assessment.

4 First Things You Should Do After You Move In

July 16, 2020 by Matt Goeglein

Congratulations on moving into your new house! But hold on. Now that the house is yours, there are a few things you will want to do in order to make life in your new home more comfortable and secure. Before you plan your housewarming party, here is a list of the first things you should do after you move in.

1. Change The Locks

As the new homeowner, you have no way of knowing how many others have keys to your new home. The previous owner may have made copies for their housekeeper, their parents, the babysitter, a neighbor, or anyone else. You definitely don’t want anyone else having keys to your home. Have a locksmith come in and change all the locks. The investment will help you sleep soundly.

2. Find Out Your Boundaries

Check in with town hall to see if there are documents on file that lay out the boundaries for the land you just purchased. If not, consider having a land surveyor come out to mark the boundaries around your new home. This will ensure that you don’t accidentally do things that encroach on your new neighbor’s land, such as planting trees or flowers, erecting a fence, or setting up a swing set.

3. Introduce Yourself To The Neighbors

Pencil in a day to go around and meet your new neighbors. Don not wait too long to do this; the longer you wait, the more awkward it becomes. In theory, they should be introducing themselves to you, but these days you could be waiting a long time for an apple pie to show up at your door. Just wait for the weekend and give a light knock on the doors on your street. Your neighbors will appreciate the gesture and you might just meet a new friend.

4. Make A House Map

A house map is just a general layout of where all the important fixtures are. The map should include the furnace, all outdoor spigots, the main water shut-off valve, the septic tank lid cover (if applicable) and the circuit box. Finally, invest in some fire extinguishers and mark their locations on the map, too. Have it laminated and put it someplace where all the family members can access it.

Once you take care of these four things, you willll feel better knowing that you’ve done all the necessary chores. Now, just sit back and enjoy your accomplishment!

04.13.20. VIRTUAL REALITY : things to do while in quarantine

Now more than ever, it’s important that we all pull together and support one another – while also taking care of our families, our friends and ourselves. We want you to know that the safety and well-being of you and those you love are our utmost priorities.

We have assembled a list of ideas and activities* intended to help you connect, reenergize and make a positive difference in the community and in your own home.

For Your Community

- Visit the websites of local food banks and homeless shelters to donate online

- Visit the websites of local animal shelters to donate online

- Support local and small businesses

- Buy gift cards (to support the business today, and use when they reopen)

- Shop from their online stores

- Support the arts

- Donate to your favorite museum or local arts organization

- Purchase a piece of work/merchandise on the website of your favorite local artist

- Watch livestreams of music and theater performances

- Take a virtual museum tour

- Support your favorite charity

- Support your local hospitals and the people in the frontline by making donations and / or masks and gloves, meals, Starbucks cards.

For Yourself and Your Own Home

- Exercise – inside or outside

- Get organized, pack up things you no longer use or needed and donate

- Get creative, start a project. It could be anything

- Bake or cook, or learn how to make cocktails

- Get some fresh air – read outside or take a nice long walk

- Do some spring cleaning around the house

- Play board games, video games or indoor sports like ping pong

- Call your friends and relatives to catch up

- Take a free virtual tour

*Please abide by any Shelter-in-Place or Stay-at-Home measures in effect in your area.

No matter what you do, DO NOT TOUCH YOUR FACE. Wash your hands often, use sanitizers, wipe down surfaces often, stay 6 feet apart when you’re in public, and wear your mask when you’re out. Finally, if you don’t feel good, please stay home..

03.19.20. Updates on Coronavirus: Everything you need to know about the infection process. Interesting article from USA Today.

What does the coronavirus do to your body? Everything to know about the infection process

A visual guide of coronavirus infection, symptoms of COVID-19 and the effects of the virus inside the body, in graphics

Javier Zarracina, and Adrianna Rodriguez, USA TODAYUpdated 10:00 a.m. PDT Mar. 16, 2020

As the COVID-19 pandemic spreads across the U.S. – canceling major events, closing schools, upending the stock market and disrupting travel and normal life – Americans are taking precautions against the new coronavirus that causes the disease sickening and killing thousands worldwide.

The World Health Organization and U.S. Centers for Disease Control and Prevention advise the public be watchful for fever, dry cough and shortness of breath, symptoms that follow contraction of the new coronavirus known as SARS-CoV-2.

From infection, it takes approximately five to 12 days for symptoms to appear. Here’s a step-by-step look at what happens inside the body when it takes hold.

Coronavirus infection

According to the CDC, the virus can spread person-to-person within 6 feet through respiratory droplets produced when an infected person coughs or sneezes.

It’s also possible for the virus to remain on a surface or object, be transferred by touch and enter the body through the mouth, nose or eyes.

Dr. Martin S. Hirsch, senior physician in the Infectious Diseases Services at Massachusetts General Hospital, said there’s still a lot to learn but experts suspect the virus may act similarly to SARS-CoVfrom 13 years ago.

“It’s a respiratory virus and thus it enters through the respiratory tract, we think primarily through the nose,” he said. “But it might be able to get in through the eyes and mouth because that’s how other respiratory viruses behave.”

When the virus enters the body, it begins to attack.

Fever, cough and other COVID-19 symptoms

It can take two to 14 days for a person to develop symptoms after initial exposure to the virus, Hirsch said. The average is about five days.

Once inside the body, it begins infecting epithelial cells in the lining of the lung. A protein on the receptors of the virus can attach to a host cell’s receptors and penetrate the cell. Inside the host cell, the virus begins to replicate until it kills the cell.

This first takes place in the upper respiratory tract, which includes the nose, mouth, larynx and bronchi.

The patient begins to experience mild version of symptoms: dry cough, shortness of breath, fever and headache and muscle pain and tiredness, comparable to the flu.

Dr. Pragya Dhaubhadel and Dr. Amit Munshi Sharma, infectious disease specialists at Geisinger, say some patients have reported gastrointestinal symptoms such as nausea and diarrhea, however it’s relatively uncommon.

Symptoms become more severe once the infection starts making its way to the lower respiratory tract.

Pneumonia and autoimmune disease

The WHO reported last month about 80% of patients have a mild to moderate disease from infection. A case of “mild” COVID-19 includes a fever and cough more severe than the seasonal flu but does not require hospitalization.

Those milder cases are because the body’s immune response is able to contain the virus in the upper respiratory tract, Hirsch says. Younger patients have a more vigorous immune response compared to older patients.

The 13.8% of severe cases and 6.1% critical cases are due to the virus trekking down the windpipe and entering the lower respiratory tract, where it seems to prefer growing.

“The lungs are the major target,” Hirsch said.

As the virus continues to replicate and journeys further down the windpipe and into the lung, it can cause more respiratory problems like bronchitis and pneumonia, according to Dr. Raphael Viscidi, infectious disease specialist at Johns Hopkins Medicine.

Pneumonia is characterized by shortness of breath combined with a cough and affects tiny air sacs in the lungs, called alveoli, Viscidi said. The alveoli are where oxygen and carbon dioxide are exchanged.

When pneumonia occurs, the thin layer of alveolar cells is damaged by the virus. The body reacts by sending immune cells to the lung to fight it off.

“And that results in the linings becoming thicker than normal,” he said. “As they thicken more and more, they essentially choke off the little air pocket, which is what you need to get the oxygen to your blood.”

“So it’s basically a war between the host response and the virus,” Hirsch said. “Depending who wins this war we have either good outcomes where patients recover or bad outcomes where they don’t.”

Restricting oxygen to the bloodstream deprives other major organs of oxygen including the liver, kidney and brain.

In a small number of severe cases that can develop into acute respiratory distress syndrome (ARDS), which requires a patient be placed on a ventilator to supply oxygen.

However, if too much of the lung is damaged and not enough oxygen is supplied to the rest of the body, respiratory failure could lead to organ failure and death.

Viscidi stresses that outcome is uncommon for the majority of patients infected with coronavirus. Those most at risk to severe developments are older than 70 and have weak immune responses. Others at risk include people with pulmonary abnormalities, chronic disease or compromised immune systems, such as cancer patients who have gone through chemotherapy treatment.

Viscidi urges to public to think of the coronavirus like the flu because it goes through the same process within the body. Many people contract the flu and recover with no complications.

“People should remember that they’re as healthy as they feel,” he said. “And shouldn’t go around feeling as unhealthy as they fear.”

Follow Adrianna Rodriguez on Twitter: @AdriannaUSAT. 0:001:13AD

Why social distancing is critical to curbing the coronavirus pandemicSocial distancing matters. Here is how to do it and how it can help curb the COVID-19 pandemic.JUST THE FAQS, USA TODAYOriginally Published 3:31 p.m. PDT Mar. 13, 2020Updated 10:00 a.m. PDT Mar. 16, 2020

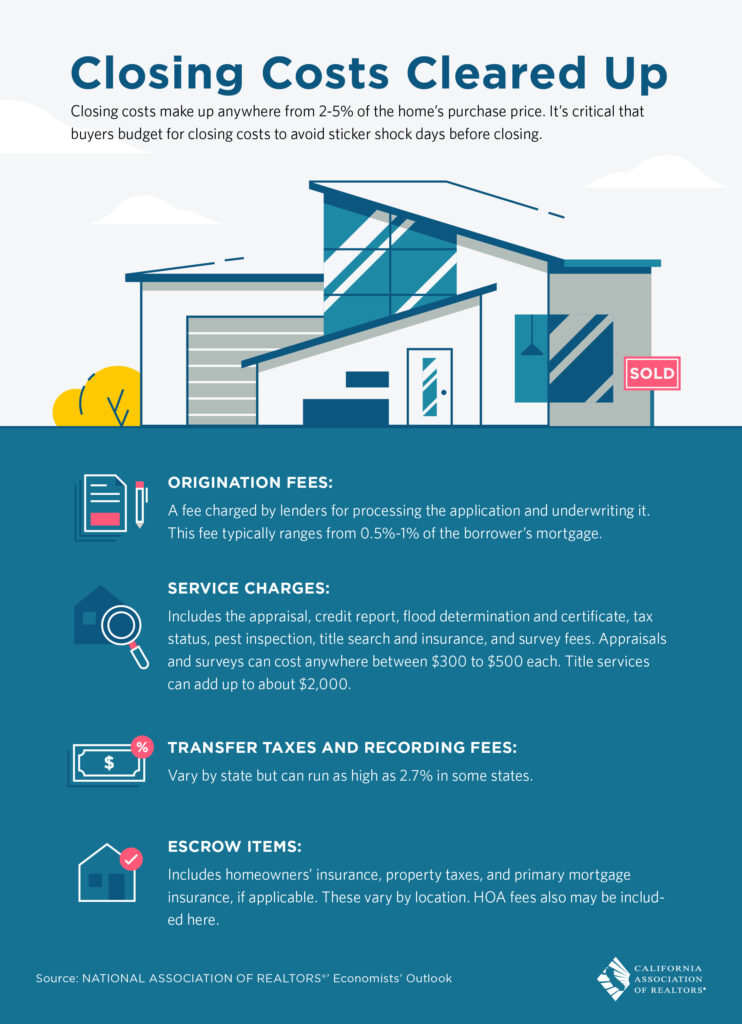

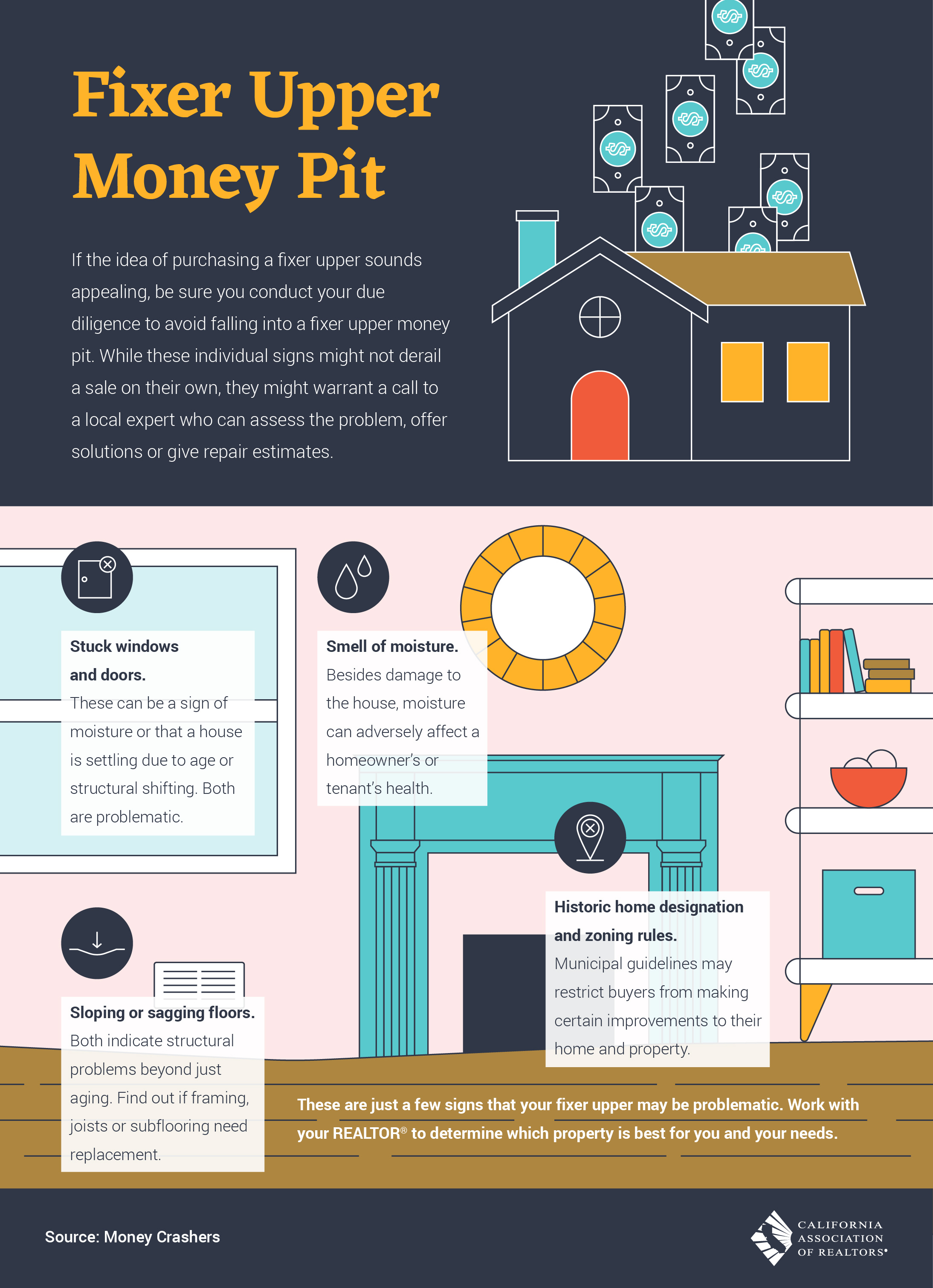

03.04.20. the money pit

5 Sweet Tax Deductions When Selling a Home: Did You Take Them All?

By Margaret Heidenry | Feb 24, 2020

You may be wondering if there are tax deductions when selling a home. And the answer is: You bet!

Sure, you may remember 2018’s new tax code—aka the Tax Cuts and Jobs Act—changed some rules for homeowners. But rest assured that if you sold your home last year (or are planning to in the future), your tax deductions when you file with the IRS can still amount to sizable savings.

Want a full rundown of all the deductions (as well as tax exemptions or other write-offs) at a home seller’s disposal? Check out this list to make sure you miss none of them.

Related Articles

- Your 2019 Home Tax Deduction Checklist: Did You Get Them All?

- How Much Is Capital Gains Tax on Real Estate? What Homeowners Need to Know to Avoid It

- How to Calculate Property Tax Without Losing Your Marbles

1. Selling costs

These deductions are allowed as long as they are directly tied to the sale of the home, and you lived in the home for at least two out of the five years preceding the sale. Another caveat: The home must be a principal residence and not an investment property.

“You can deduct any costs associated with selling the home—including legal fees, escrow fees, advertising costs, and real estate agent commissions,” says Joshua Zimmelman, president of Westwood Tax and Consulting in Rockville Center, NY.

This could also include home staging fees, according to Thomas J. Williams, a tax accountant who operates Your Small Biz Accountant in Kissimmee, FL.

Just remember that you can’t deduct these costs in the same way as, say, mortgage interest. Instead, you subtract them from the sales price of your home, which in turn positively affects your capital gains tax (more on that below).

2. Home improvements and repairs

Score again! If you renovated a few rooms to make your home more marketable (and so you could fetch a higher sales price), you can deduct those upgrade costs as well. This includes painting the house or repairing the roof or water heater.

But there’s a catch, and it all boils down to timing.

“If you needed to make home improvements in order to sell your home, you can deduct those expenses as selling costs as long as they were made within 90 days of the closing,” says Zimmelman.

3. Property taxes

This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property taxes this year up to $10,000.

4. Mortgage interest

As with property taxes, you can deduct the interest on your mortgage for the portion of the year you owned your home.

Just remember that under the 2018 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got their mortgage before Dec. 15, 2017, can continue deducting up to the original amount up to $1 million, according to Zimmelman.

Note that the mortgage interest and property taxes are itemized deductions. This means that for it to work in your favor, all of your itemized deductions need to be greater than the new standard deduction, which the Tax Cuts and Jobs Act nearly doubled to $12,200 for individuals, $18,350 for heads of household, and $24,400 for married couples filing jointly. (For comparison, it used to be $12,700 for married couples filing jointly.)

5. Capital gains tax for sellers

The capital gains rule isn’t technically a deduction (it’s an exclusion), but you’re still going to like it.

As a reminder, capital gains are your profits from selling your home—whatever cash is left after paying off your expenses, plus any outstanding mortgage debt. And yes, these profits are taxed as income. But here’s the good news: You can exclude up to $250,000 of the capital gains from the sale if you’re single, and $500,000 if married. The only big catch is you must have lived in your home at least two of the past five years.

However, look for the rules of this exemption to possibly change in a future tax bill.